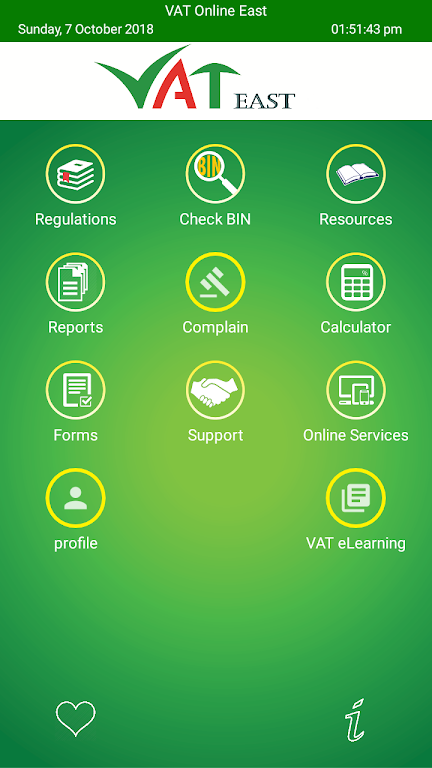

Introducing VAT East, the ultimate app streamlining VAT processes for consumers, taxpayers, tax officials, and procuring entities. VAT East simplifies BIN (or eBIN) verification, enabling users to quickly assess the trustworthiness of businesses before transactions. The app also facilitates complaint lodging against taxpayers, allowing tax officials to address concerns effectively. Taxpayers can easily locate nearby VAT offices in Dhaka East, receive timely compliance reminders, and access comprehensive resources including regulations, guidelines, and support center information.

Features of VAT East:

⭐️ BIN Verification: Instantly verify the authenticity and status of VAT registration numbers, identifying potentially risky businesses.

⭐️ Complaint Management: Submit complaints against taxpayers; tax officials receive and manage feedback, ensuring accurate reporting of tax evasion. Users may receive rewards for accurate information.

⭐️ VAT Office Locator: Quickly find the nearest VAT office within the Dhaka East VAT Commissionerate, complete with directions.

⭐️ Compliance Reminders: Receive timely notifications and SMS reminders for monthly VAT Returns and Quarterly ToT Returns, preventing missed deadlines.

⭐️ Compliance Acknowledgement: Receive confirmation and appreciation from the Commissioner upon successful submission of VAT or Turnover Tax returns.

⭐️ VAT Professional Directory: Access a directory of active VAT Consultants, Agents, and Alternative Dispute Resolution (ADR) providers for assistance.

Conclusion:

VAT East offers a comprehensive solution for all your VAT needs. Download the app today and simplify your VAT interactions.

Tags : Communication