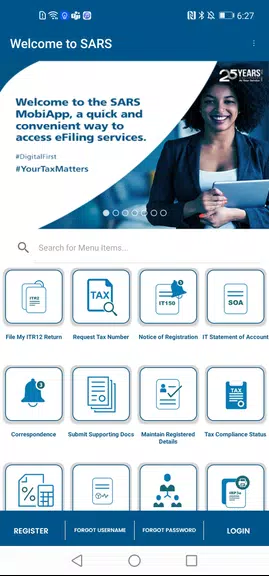

Features of SARS Mobile eFiling:

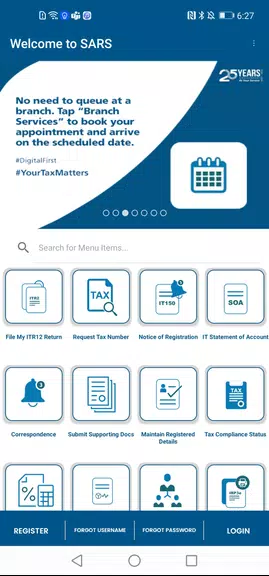

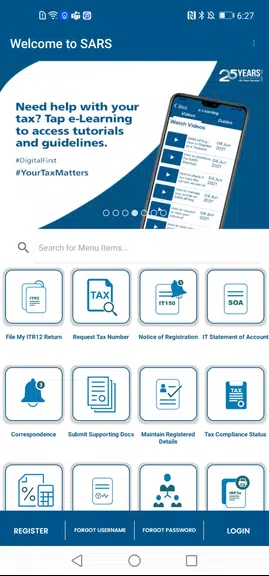

Convenience: With the SARS Mobile eFiling app, filing your annual Income Tax Returns is as simple as tapping on your smartphone, tablet, or iPad. It’s designed to make the tax filing process quick and effortless.

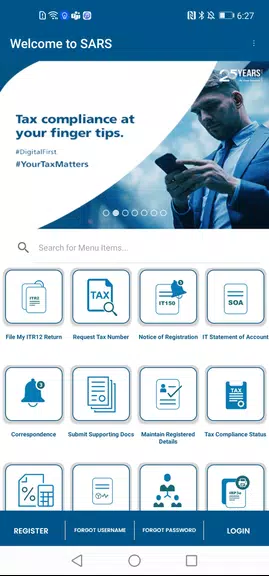

Accessibility: The app provides unparalleled access, allowing you to manage your taxes at your convenience, whether you’re at home, at work, or on the move.

Security: Your peace of mind is paramount. The app employs stringent security measures to ensure that all your submitted information is protected and encrypted.

Tax Calculator: Utilize the integrated tax calculator to get an immediate estimate of your assessment outcome, enabling better financial planning and budgeting.

FAQs:

Is the SARS Mobile eFiling app secure?

Absolutely, the app is built with top-tier security features, and all information you submit is encrypted to safeguard your data.

Can I access my past tax returns through the app?

Yes, you can review a summary of your Notice of Assessment (ITA34) and Statement of Account (ITSA) directly within the app.

Can I use the app to file my business taxes as well?

Currently, the app supports only individual taxpayers for their personal Income Tax Returns. Business tax filing is not yet available through the app.

Conclusion:

The SARS Mobile eFiling app is an essential tool for any taxpayer looking to simplify and streamline their tax filing experience. With its blend of convenience, accessibility, and security, it caters to both seasoned eFilers and newcomers alike. Make tax filing easier than ever by downloading the SARS Mobile eFiling app today and take charge of your taxes wherever you are.

Tags : Finance